Keep Your Profits In Check: The Significance of Dividend Tracking and Journal Keeping in Stock Investing

Dividend Tracking and Journal Keeping in Stock Investing

..."Investing in the stock market can be a rewarding but complex process. It involves evaluating companies, understanding market trends, and making well-informed decisions to maximize profits. However, even the most successful investors can fall short if they neglect dividend tracking and journal keeping."

*This blog provides educational and informational content only and should not be considered financial advice. The information presented is based on research and personal experiences, but readers should conduct their own research and seek professional advice before making any financial decisions. The blog and its author are not liable for any losses or damages resulting from reliance on the information provided. Readers are responsible for their own financial decisions and should exercise caution and diligence when interpreting and applying the information shared.*

Disclaimer: This blog may contain affiliate links within the posts. These links allow us to earn a small commission from any purchases made through them, which helps support the blog and its content. Rest assured that we only recommend products or services that we genuinely believe in and have personally used or researched. Your trust is important to us, and we are committed to providing valuable and unbiased information. Thank you for your support

1. Introduction

Investing in the stock market can be a rewarding but complex process. It involves evaluating companies, understanding market trends, and making well-informed decisions to maximize profits. However, even the most successful investors can fall short if they neglect dividend tracking and journal keeping.

Dividend tracking involves monitoring the amount and frequency of dividends paid out by companies in which you have invested. Journal keeping involves maintaining accurate records of your investment decisions, strategies, and outcomes.

Both of these practices are essential for investors to keep their profits in check, minimize risks, and improve overall performance. In this blog, we will discuss the significance of dividend tracking and journal keeping in stock investing and provide practical tips to help you succeed in the market.

2. The importance of dividend tracking and journal keeping in stock investing

Dividend tracking and journal keeping are critical components of stock investing. These practices allow investors to track their progress and improve their overall performance.

Dividend tracking involves monitoring the amount and frequency of dividends paid out by companies in which you have invested. This information allows investors to assess the potential returns on their investments and adjust their strategies accordingly.

Journal keeping involves maintaining accurate records of your investment decisions, strategies, and outcomes. This records give investors insights into their thought processes and decision-making abilities. Additionally, it allows them to track their progress over time and identify areas for improvement.

Dividend tracking and journal keeping can help investors to make informed decisions, minimize risks and improve their performance. Without them, investors are at risk of making uninformed decisions, missing out on potential profits and putting their investments at risk.

In conclusion, dividend tracking and journal keeping play a fundamental role in stock investing. They are essential tools for investors to track their progress, make informed decisions, and ultimately maximize their profits. By implementing these practices, investors can improve their overall performance and achieve long-term success in the stock market.

3. What are dividends and why are they important?

Dividends are a portion of a company's earnings that is paid out to its shareholders. Dividend payments are usually made in cash or additional shares of stock, and the amount and frequency of payment may vary depending on the company's profitability and financial stability.

One of the primary reasons why dividends are important in stock investing is that they provide a source of income to investors. By investing in dividend-paying stocks, investors can earn a regular stream of passive income that can help them meet their financial goals.

Another benefit of dividends is that they can help to stabilize a portfolio's returns. By investing in dividend-paying companies, investors can receive a steady income stream regardless of market conditions. This can be especially beneficial during times of market volatility or economic downturns when stock prices may be more volatile.

Additionally, dividends can be an indicator of a company's financial health and stability. Companies that regularly pay dividends are often well-established and profitable, with a history of consistent earnings growth.

In summary, dividends are an important aspect of stock investing because they provide a source of income, stabilize portfolio returns, and serve as indicators of a company's financial health. By tracking and analyzing dividend payments, investors can make more informed investment decisions and improve their overall performance in the stock market.

4. How to track dividends effectively

Tracking dividends is crucial for investors to ensure they are receiving the expected income from their investments. Here are some effective ways to track dividends:

1. Create a dividend tracking spreadsheet - This can be simple or complex, depending on the investor's needs. It should include the name of the company, the dividend amount, the ex-dividend date, the payment date, and the yield.

2. Use stock tracking apps - There are various apps available that allow investors to track dividends, such as Yahoo Finance, Google Finance, and Seeking Alpha. These apps can also provide notifications for important dividend dates.

3. Monitor dividend announcements - Companies typically announce their dividends a few weeks before the ex-dividend date. Investors should keep an eye on these announcements to know when to expect payments.

4. Look at historical dividend payments - A company's dividend history can provide insight into its stability and long-term performance. Investors should research a company's past dividend payments to establish a pattern and determine if it is a reliable source of income.

5. Keep a journal - Keeping a journal can be beneficial for investors to record their thoughts and decisions regarding dividends. They can also track their portfolio's performance over time and make adjustments if necessary.

By tracking dividends effectively, investors can stay on top of their investments' performance and ensure their portfolio is generating the desired income.

5. Understanding the benefits of keeping a journal in stock investing

Keeping a journal is an essential component of successful stock investing. It enables investors to document their thoughts regarding their investments and track their portfolio's performance over time. Here are several benefits of keeping a journal in stock investing:

1. Helps track progress – Recording the progress of your investments in a journal provides an opportunity for reflection, evaluation, and adjustment. It helps to identify investments that are not performing well and to make timely decisions.

2. Provides an overview – A journal provides you with a comprehensive overview of your investment strategy. With time, you can see the progression of your investments, where you’ve gained, and where you’ve lost.

3. Encourages discipline – Keeping a journal helps investors to stay disciplined and focused. It also provides an opportunity to identify areas where discipline is lacking and make the necessary adjustments.

4. Facilitates learning – By documenting their thoughts, and tracking their investments, investors can learn from their experiences. They can identify mistakes made and avoid repeating them in the future.

5. Helps navigate challenges – Market conditions can be unpredictable, and keeping a journal provides investors with a roadmap for navigating the tough times. Investors can refer to their journal to assist them in making informed decisions during market volatility.

By keeping a journal, investors can monitor their progress, maintain discipline, learn from their experiences, navigate challenges, and ultimately achieve their investment goals.

6. Journal keeping tips for effective dividend tracking

Journal keeping is equally important when it comes to dividend tracking in stock investing. Here are six tips to help you keep an efficient dividend tracking journal:

1. Set clear investment goals – Before starting to track your dividends, set clear goals. Identify the expected returns from your investments and your desired outcome. This information is essential in setting up parameters for your tracking process.

2. Organize and record information – Create a system to organize and record your dividend information. This system should include the name of the stock, the purchase date, the dividend amount, and the payment date.

3. Update your journal regularly – Make sure you update your journal frequently to keep track of changes in investment performance. Regular updates help you stay informed about the value of your investments and identify any discrepancies that may arise.

4. Review your investment strategy – Regularly review your investment strategy to ensure that it is aligned with your investment goals. You may need to adjust your strategy to optimize your investment returns.

5. Analyze your performance – Analyze your dividend tracking information to identify areas for improvement. This analysis can help you adjust your investment strategy, minimize investment risks and maximize returns.

6. Seek assistance when necessary – Do not hesitate to seek assistance when necessary. This may involve consulting with a financial advisor or a seasoned investor to help you analyze your dividend tracking data and develop an effective investment strategy.

Keeping an effective dividend tracking journal can help you make informed investment decisions, develop an effective investment strategy, and ultimately achieve your investment goals.

7. Staying on top of your profits with dividend tracking and journal keeping

Dividend tracking and journal keeping are essential for staying on top of your profits in stock investing. Here are some more tips to help you keep track of your dividends and stay ahead of the game:

1. Set up alerts for dividend payments – Most stock brokers offer alerts for dividend payments. Set up these alerts to stay informed of your dividend payments and avoid missing them.

2. Monitor dividend yield – The dividend yield is the annual dividend payment divided by the stock price. Monitoring the dividend yield will help you identify opportunities for maximizing your investment returns.

3. Reinvest dividends – Reinvesting dividends can increase your overall investment returns significantly. Make sure to check your broker's reinvestment options and set up automatic reinvestment if possible.

4. Keep track of taxes – Dividend income is taxable, and it is essential to keep track of your taxable income and report it accurately. Consider consulting with a tax professional to help you organize and report your dividend income.

5. Compare dividend stocks – Compare dividend stocks to identify the best investment opportunities. Look for companies with a history of steady dividend payments and high dividend yields.

6. Diversify your portfolio – Diversification is key in stock investing. Consider investing in different types of stocks, such as growth stocks and value stocks, to minimize your investment risks and maximize your returns.

7. Stay informed – Keep yourself informed of changes in the stock market and your stocks by regularly reading financial news and reports. This knowledge will help you make informed investment decisions and stay ahead of the game.

By following these tips and maintaining an efficient dividend tracking journal, you can stay on top of your profits and achieve your investment goals. Remember, investing in the stock market involves risks, and it is crucial to do your research and seek professional advice when necessary.

8. Conclusion

In conclusion, dividend tracking and journal keeping are essential for staying on top of your profits in stock investing. Remember to set up alerts for dividend payments, monitor dividend yield, reinvest dividends, keep track of taxes, compare dividend stocks, diversify your portfolio, and stay informed of changes in the stock market. Additionally, don’t forget the significance of editing and proofreading in writing, as they help ensure your manuscript flows smoothly, follows a logical order, and is coherent. By understanding these concepts and practicing them regularly, you can achieve your goals and succeed in your endeavors.

Blog-Book

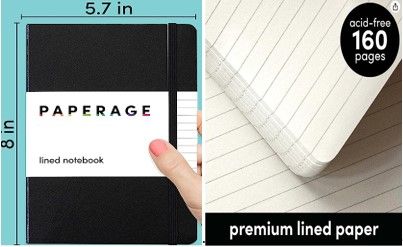

this is one of many books that have assisted me on my financial journey.

"Investment Mastery: Think and Grow for Goal-Setting in the Market"

Description: "Investment Mastery" is a comprehensive guide that combines the principles of goal-setting from "Think and Grow Rich" with practical strategies for success in the stock market. This book will empower readers to harness the power of their thoughts and align their financial goals with effective investment practices. Drawing on the principles of desire, belief, persistence, and visualization, it provides a roadmap for setting and achieving meaningful goals in the dynamic world of investing. From defining financial aspirations to developing disciplined investment plans, this book equips readers with the mindset and tools to navigate the market and build long-term wealth. Whether you are a novice investor or seeking to enhance your investment skills, "Investment Mastery" will inspire and guide you towards reaching your financial objectives through purposeful goal-setting in the market.

By combining the motivational principles of "Think and Grow Rich" with actionable strategies specific to the stock market, "Investment Mastery" offers a unique perspective on achieving financial success through goal-setting in investment endeavors